What you think you know now. But the question still remains, do you know what you think you know? When should you have fled the market? When should have you bought gold? Should you have ever had any money in the bank or a retirement account?

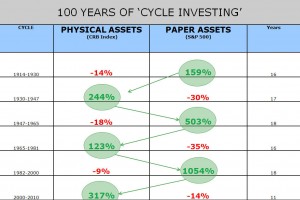

Below is a chart that shows the gains and losses one would have made by moving in and out of the S&P index and the CRB index that is tied to physical commodities. It appears that the cycle is 17 years on average. Yet the “business cycle” is often said to be a 8 year cycle.

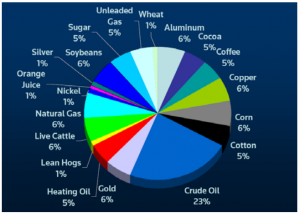

The CRB index is comprised of 19 commodities: Aluminum, Cocoa, Coffee, Copper, Corn, Cotton, Crude Oil, Gold, Heating Oil, Lean Hogs, Live Cattle, Natural Gas, Nickel, Orange Juice, Silver, Soybeans, Sugar, Unleaded Gas and Wheat.

via Thomson Reuters | Thomson Reuters Commodity Indices | Financial.